News Article

Change And Growth In The UK

Recently, Solar UK the opportunity to catch up with Finlay Colville, team leader and vice-president at NPD Solarbuzz on the current status of the UK solar PV industry, and put some questions to him related to changes in the UK solar industry.

Q The UK solar has continued to grow at an impressive rate and recent data, published by NPD Solarbuzz, shows that cumulative solar PV deployed in the UK has reached the 5 gigawatt level. Compared to where we were 12 months ago, does this come as a surprise?

A This time last year, we were embroiled in the midst of a trade case between the European Union and China regarding the import of Chinese silicon based solar modules to the European PV markets. And the outcome was far from clear. The UK had just had a strong first quarter at the start of 2013 for large scale solar farms, and many were concerned that the EU could limit the availability of Chinese panels.

As it turned out, the EU chose to go down the route of minimum price and quota levels and not to impose an import duty that would have been more damaging. While the minimum price required a reset in solar farm capex, it was not a show-stopper. The UK was also emerging as the key European market, with Germany and Italy seeing declining demand. Therefore, the very real possibility of the UK being the victim of the EU/China trade case was mostly averted.

The wise money was on the UK market being at about 4.5 gigawatts today, some 0.5 gigawatts below the actual figure. The growth to 5 gigawatts was largely a consequence of the very strong first quarter this year, before the 1.6 ROCs level declined at the end of March 2014. The UK managed to install well over 1 gigawatt in the final four months, leading up to the 1 April ROC decline. Much of this was due to solar farm deployment, and within this, Lightsource Renewables was certainly the over-performer.

Q The last twelve months certainly held surprises but overall market metrics were positive. What sort of year can the industry expect in light of changes coming up?

A Well, that is much more difficult proposition, because there are now a host of swing factors that are all in the balance. But the best way to look at this is to go through some of the factors in the mix.

First, the small scale FiT segment, that includes all the domestic residential rooftop installation, has shown itself to be somewhat resilient, in comparison with the ups and downs of the large scale ground-mounted activity. Small scale FiTs are not due to degress until 1 January 2015, offering installers 4-5 months of stable incentive rates.

The large-commercial rooftop market is not expected to see strong uptick over the next 12 months, mainly because there are still no changes to funding levels. The move to increase the capacity threshold that triggers a full planning application will help, but it does not change the economics of the segment. New financial drivers may allow more creative demand growth in this segment over time, potentially from more third-party leasing, but the big money is headed for large-scale solar farms until 31 March 2015 and this is more than likely to get priority over the large rooftop segment now.

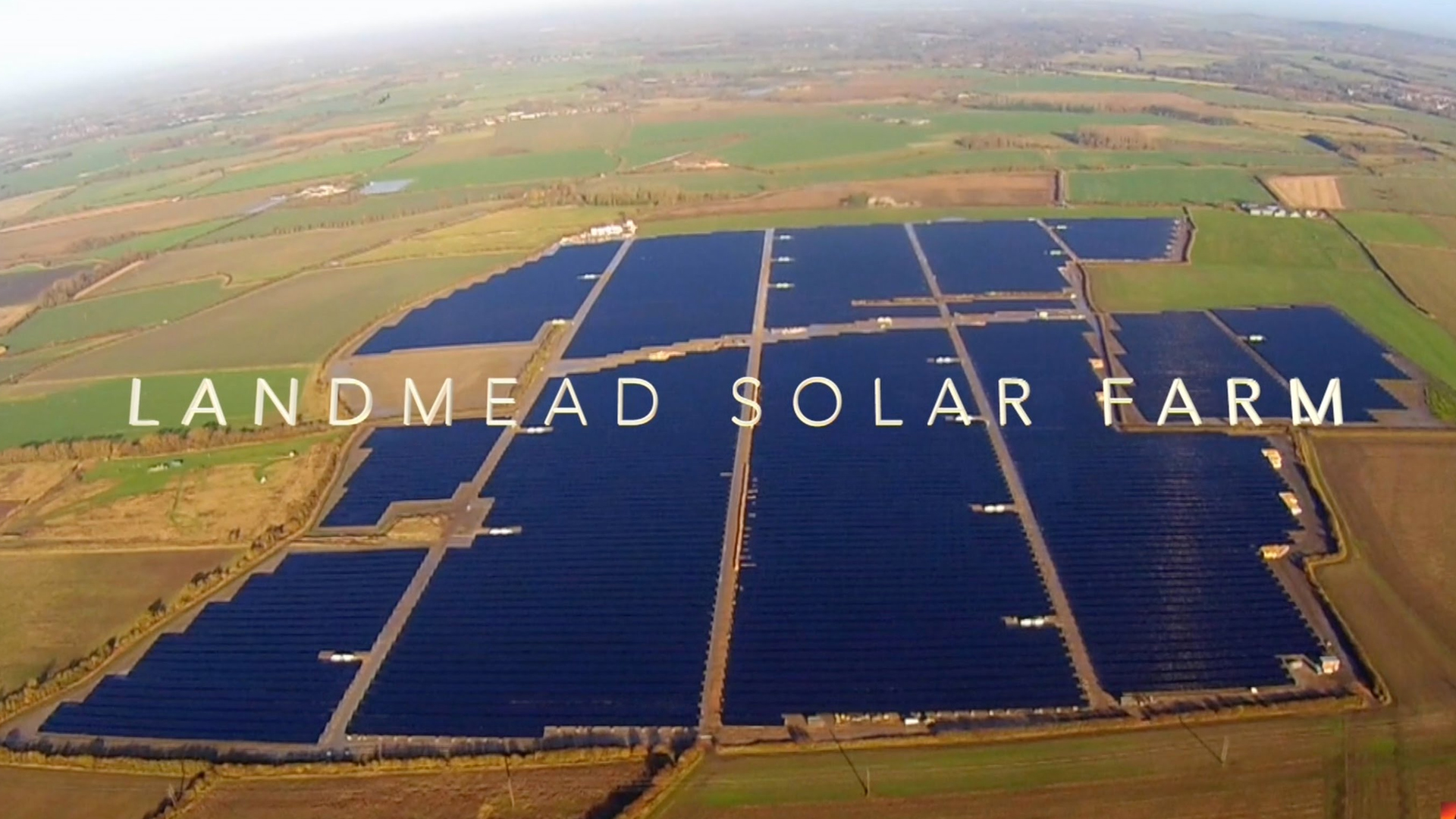

Ground-mount deployment over the next 12 months is the key swing component. Before 1 April 2015, policies are set in stone and it will simply be build-build-build under 1.4 ROCs. This can be seen clearly in the increased applications and consultations going on even now, with new planning applications going in at a very high rate.

While many developers will be hoping to hedge their bets on options that may or may not be on the table after 31 March 2015, the goal will be to interconnect under 1.4 ROCs.

The question of ROCs after 31 March 2015 is not yet clear. Nor is the exact nature of what will be eligible to carry over under the grace term conditions finally released. Most have simply accepted that >5MW ground-mount solar PV farms will no longer be eligible under ROCs. The open questions relate to grace terms, and the final decision on sub-5MW ROC continuation.

The May 2014 outline from DECC is still a draft proposal. There is nothing final to work off right now, making ROC deployment after 31 March 2015 almost impossible to call.

The other issue on the table is the CfD auction in October 2014. This too has many questions, but mainly because it takes much of the UK's renewable sector (solar and wind and other renewable energy types) into unchartered territory. It will not be until the end of this year that we really start to learn what the outcome will mean for large-scale deployment.

Figure 1: Solar PV farms in the 5-20MW range account for two-thirds of the >1MW ground-mounted solar PV pipeline in the UK. Source: NPD Solarbuzz UK Deal Tracker report, July 2014.

Q The solar industry is almost as dependant on the global market as it is the domestic. What is happening on the global PV scene and are there any changes that could have unexpected benefits or surprises for the UK solar industry?

A Mainland Europe solar PV demand is still trending downwards. In fact, the UK is the bright spot this year, and will probably remain so in 2015 due to its strong residential segment and the sheer scale of ground-mounted shipments during Q1 2015. So, competition for Chinese supply under the quota is probably not something to worry about. If other European markets were to grow quickly, then questions would arise due to Chinese quota levels and whether there would be a shortfall of Chinese modules for UK solar farms.

Globally, trade wars are having some unexpected effects. The US/China case is now in round 2, following the 2012 ruling from the US Department of Commerce. The impact is actually more likely to be felt in Taiwanese manufacturing and Japanese end-market supply, in the short-term, than massive changes in supply to the US market. No country is totally immune to a full-blown US/China trade case, but the UK may only see secondary effects in the near term.

Otherwise, the UK will be the main European pull for US and Chinese equity, mainly from integrated suppliers that both ship modules and build solar farms.

Q The solar and PV industry is seeing a number of trade disagreements that seem more inline with protecting domestic manufacturing. This would seem likely to place more pressure on the development of any UK based manufacturing opportunities?

A As of today, manufacturing is limited mainly to mechanical parts related to mounting of panels, with some other electronics or balance of systems parts "“ similar to most end-markets. Modules and inverters are imported. There are a couple of small module fabs. Sharp has been auctioning off its equipment recently, having closed module fabrication completely in Wrexham some months ago. PV Crystalox has been hit by Asian ingot manufacturing also, and have a fraction of the market share they had when the European market was strong 5 years ago.

While highly unlikely, nothing can ever be ruled out. However, the odds are firmly stacked against PV manufacturers. Manufacturing needs significant support from governments, especially when starting up, and the same government needs to be wholly committed to the end-market the manufacturer is going to supply into. It would be hard to make that case in the UK today.

Possibly, the best way to look at it is as a much longer play. Is there something that "“ while very high risk today, or largely blue-sky "“ might just offer a breakthrough in five or ten years. But anything short of five years, there is minimal hope.