NextPower V ESG Makes CfD Acquisition

NextEnergy Capital, a global renewables manager specialised on the solar+ infrastructure sector, is delighted to announce NextPower V ESG has made its first acquisition in Poland.

The portfolio comprises operating plants totalling 65.6MW and benefits from 100% contracted revenues that are CPI linked for at least 15 years after being awarded a Contract for Difference (“CfD“) through the domestic renewable energy auctions. The portfolio was acquired from an experienced investor and developer of renewable energy projects that manages over 2GW of projects in various stages of development in the region.

This acquisition highlights the momentum in capital deployment and follows the acquisition of a 100MW project in Florida. It also demonstrates the continued success of NEC in Poland, having recently refinanced a €46.5 million debt financing facility for NextPower III ESG ("NPIII ESG”) across a 94MW operating solar portfolio in the country. NPIII ESG is NPV ESG's predecessor OECD investment fund. The refinancing enabled NextPower III ESG to recycle further capital into its projects in construction across Europe.

NPV ESG is an OECD-focused solar and battery storage strategy targeting $1.5 billion with a $2 billion hard cap that has recently secured a $265 million second close after investment commitments from a UK LGPS investment pool, a Dutch pension fund, and another re-up from an existing NPIII ESG investor and reached $745 million (including $150million for co-investments) in total commitments to date.

NPV ESG’s investment strategy targets the solar+ infrastructure sector in carefully selected OECD markets, with the objective of building significant portfolios in each target market, creating value with a hands-on approach, establishing an operational track record before divesting the portfolio before the end of the fund’s life in 2033. NPV ESG leverages NEC’s track record of successful investments in the solar+ infrastructure sector since 2007, with over 400 utility-scale projects acquired and previous funds delivering superior financial returns to investors.

NPV ESG has several other investment opportunities from its 18GW pipeline that NEC is targeting to close in short order. NPV ESG is expected to pay dividends, even during the investment phase. NPV ESG’s pipeline includes projects in Spain, Poland, Italy, Canada, and the US.

Upon reaching its investment ceiling and delivering c.4GW, NPV ESG is forecasted to generate enough clean energy to power the equivalent of up to 1.1 million households per year and avoid an estimated fossil fuel consumption of up to nearly 220 million m3 of natural gas annually. This underscores NEC’s commitment to sustainable investing and aligns with its mission of leading the transition to clean energy while generating attractive financial returns for its investors.

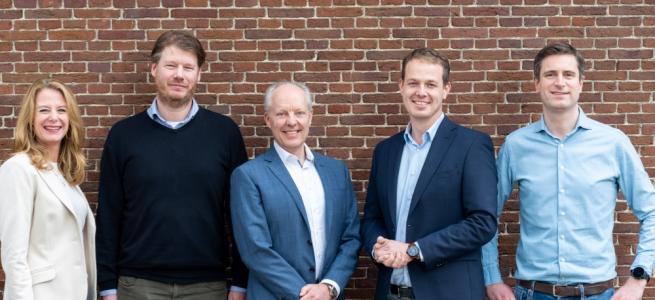

Aldo Beolchini, Managing Partner and Chief Investment Officer at NextEnergy Group, commented:

“The acquisition of the solar PV portfolio in Poland rapidly follows the recent announcement on NPV ESG securing a $265 million second close. As we progress towards our investment ceiling and deliver on our pipeline of projects across Europe, Canada, and the US, we are helping countries make significant strides in reducing their fossil fuel consumption, increasing energy independence and lowering power prices for consumers.”

Antonio Salvati, Managing Director and Head of NextPower V ESG at NextEnergy Capital, said:

“We are delighted to announce NextPower V ESG's inaugural acquisition in Poland, with this 65.6MW solar PV portfolio. The acquisition marks a significant milestone in our commitment to the solar+ infrastructure sector, propels our mission of leading the clean energy transition, and at the same time offers attractive returns for investors.”