NextPower V ESG Reaches $745 Million To Date

NextEnergy Capital, a global renewables manager specialised on the solar+ infrastructure sector, is delighted to announce the conclusion of its second close of $265 million for its fifth strategy, NextPower V ESG (“NPV ESG”). NPV ESG is an OECD-focused solar and battery storage strategy targeting $1.5 billion with a $2 billion hard cap that has secured $745 million in total commitments to date.

The new capital includes commitments from a UK LGPS investment pool, a Dutch pension fund, and another re-up from an existing NextPower III ESG investor. These new investors join existing NPV ESG investors KLP, a German occupational pension fund, and a large Nordic pension fund. NPV ESG will continue welcoming further capital, with several investors currently active in due diligence.

NPV ESG’s investment strategy targets the solar+ infrastructure sector in carefully selected OECD markets, with the objective of building significant portfolios in each target market, establishing an operational track record and divesting the portfolio at the end of the fund’s holding period in 2033. NPV ESG leverages NEC’s track record of successful investments in the solar+ infrastructure sector since 2007, with over 400 utility-scale projects acquired and previous funds delivering superior financial returns to investors.

NPV ESG has started its investment cycle with a c.100MW utility-scale solar project under construction in Highland County, Florida, USA, and has several other investment opportunities from its 18GW pipeline that are currently under exclusivity and will close shortly, including 118MW of operational projects with CfD contracts. The fund is expected to pay dividends, even during the investment phase. NPV ESG’s pipeline includes projects in Spain, Poland, Italy, Canada, and the US.

Upon reaching its investment ceiling and delivering c.4GW, NPV ESG is forecasted to generate enough clean energy to power the equivalent of up to 1.1 million households per year and avoid an estimated fossil fuel consumption of up to nearly 220 million m3 of natural gas annually. This underscores NEC’s commitment to sustainable investing and aligns with its mission of leading the transition to clean energy, while generating attractive financial returns for its investor.

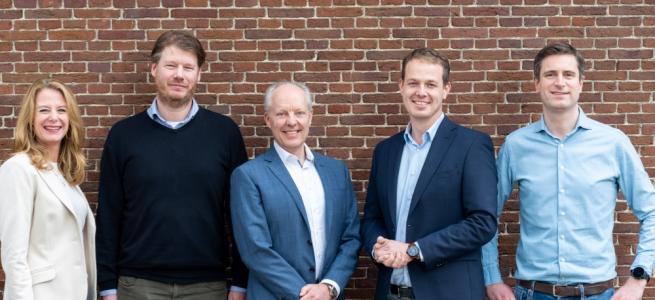

Michael Bonte-Friedheim, CEO and Founding Partner of NextEnergy Group, said:

“I am delighted to announce the second close of NextPower V ESG, with commitments from both new and existing institutional investors. Our continued fundraising progress demonstrates that NextEnergy Capital’s strategies continue to offer attractive investment opportunities for investors alongside making a sustainable long-term impactful investment.

NextEnergy Capital continues to expand its reach as the go-to specialist solar+ investment manager focused on OECD markets. Since its first close last year, NextPower V ESG has now received total commitments of $745 million to date, and its inaugural asset in the USA has started construction and secured a long-term power purchase agreement. The fund continues to draw significant interest from investors worldwide and I look forward to continuing our global fundraising activities and to announcing further investor commitments to NextPower V ESG and further fund investments shortly.

We are leveraging our very large pipeline to secure attractive assets for NextPower V ESG with a view to building an attractive and diversified portfolio.”

Shane Swords, NextEnergy Capital Managing Director and Global Head of Investor Relations, said:

“We are pleased to announce another strong close for NextPower V ESG, bringing commitments to $745 million, and would like to welcome and thank our new and existing investors in the fund. NextPower V ESG is our largest international fund to date that continues to deliver on NextEnergy Capital’s exemplary track record by showcasing positive fundraising momentum and portfolio growth. NextPower V ESG provides a real impact and tangible benefits to the communities and countries where its assets are located, whilst also providing an opportunity for investors looking for strong and stable renewable energy returns.

Investors continue to seek a specialist investment manager with a proven track record of successful delivery, deployment, and superior return generation, and we are thrilled that our experience in solar, and vast opportunities in the solar+ sector continue to be recognised as the go-to investment manager in this field.”